Early bird or second mouse – which is it for new entrants buying up assets from big oil around the world?

Major oil companies are divesting their assets around the world to focus on their most profitable projects, shore up balance sheets, contend with ever more assertive national oil companies and concentrate (to varying degrees) on transitioning their businesses to low carbon energy production. The combined asset divestments of the 8 majors – Shell, Exxon Mobil, Chevron, Total, BP, ENI, Equinor and ConocoPhillips – is expected to reach $100 billion based on recent analyst research.[1]

The events this year have accelerated divestment plans. On 9 March, we saw the biggest single day drop in Brent Crude Oil in almost 30 years (24%) due to an OPEC+ failure to agree supply cuts.[2] A few weeks later, the onset of global lockdowns meant planes were grounded and there were less cars on the roads as the world transitioned to working-from-home, further compounding the supply glut.[3] Another factor that cannot be understated is the significance is the societal tipping point in widespread demands for a lower carbon energy future. This has reached fever pitch as governments (most recently China)[4], capital investors[5] and major global businesses[6] all publicly commit to lower carbon emission goals.

What is the criteria that determines what to sell and what to hold?

Analysts have suggested that there could be various criteria driving divestment decision-making, including: (1) selling the highest GHG emitting assets; (2) the lowest margin assets; (3) consolidating positions based on geographic plays; and (4) selling based on business imperatives in terms of immediate cash flow and investor expectations.[7]

Who will buy?

Given the relatively gloomy outlook for oil and gas majors, one might expect the demand side for these assets to be low. This does not seem to be the case with some majors effectively swapping assets as part of consolidation plays and national oil companies (backed by sovereign states) and private equity backed new entrants seizing opportunities to pick up bargains. These smaller buyers approach these assets with a strategy of running their newly acquired portfolio as lean and efficiently as possible. Recent examples of this are INEOS and its gradual acquisition of assets from BP,[1] as well as PTTEPs acquisition of Murphy Oil Malaysia’s assets[2]

Are national oil companies or new private equity backed entrants immune from the Economic Social and Governance (ESG) investor pressure?

Arguably yes. By not being publicly listed, national oil companies and private equity investors are more insulated from ESG public investor pressure and societal “license to operate” pressures faced by the majors which are publicly listed household names. Of course over a longer-term NOC’s are ultimately arms of government that have signed up to Paris Agreement and have their own carbon reduction goals, but there is no “share price ticker” over the heads of privately held companies in the same way their listed counterparts. The forecasts for oil and gas demand shows the demand slowing with peak demand likely to be reached in the next decade (albeit forecasts vary based on differing assumptions).[3] Nevertheless, the same forecasts also show that primary energy demands in 2050 will still largely be met by gas and to a lesser extent oil (circa 45%). Therefore, despite the unprecedented global events and widespread negative sentiment there, is still predicted to be a role for oil and gas as part of the energy mix for the next 30 years.

Caveat emptor – what price assurance on asset valuations?

On the expectation these divestments take place, the question for both seller and buyer is asset valuation based on the economics and assumed liabilities. Whilst both parties will take advice from their financial advisors to guide their interests through this process, there is often a need for independent technical and commercial due diligence on the assets.

This technical and commercial due diligence typically includes rhi advising our buy side client’s decision-making by giving an independent view of:

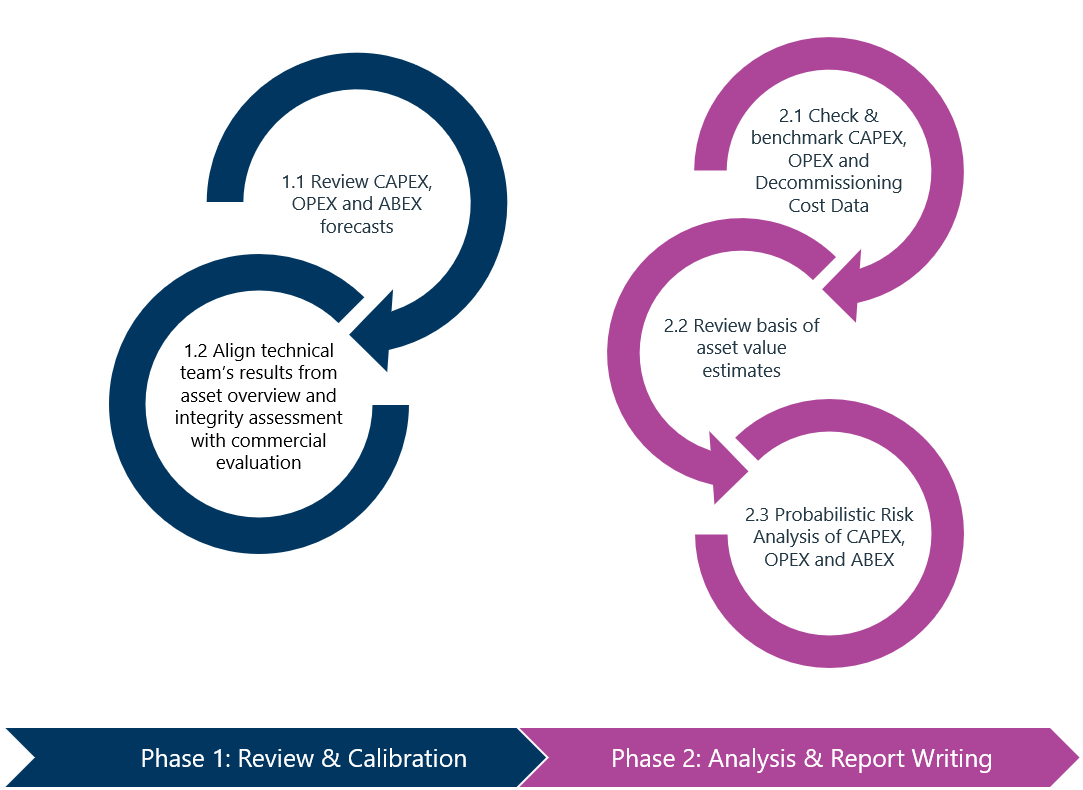

- The operators stated capital projects (CAPEX) and operating expenditure (OPEX) forecasts and end-of-life abandonment (ABEX) commitments. By providing an independent review rhi assures the basis for our clients purchase price and in so doing identifies any expenditure gaps that may be material in terms of purchase price.

- Align the operator’s forecasts with results from an independent technical asset overview and integrity assessment *, identifying and clarifying any gaps as well as assessing assumptions made.

- Sense check data provided of the capital and operating expenditure, and rehabilitation and end-of-life/decommissioning costs for accuracy. This will involve the application of benchmark costs of projects with similar scope.

- Review contracting strategies and schedule durations for any projects in development / execution

Conduct Quantitative Risk Analysis of the CAPEX,OPEX and ABEX cost estimates using Monte Carlo simulation to provide ranges for these costs.

These services may typically be undertaken on a phased basis, comprising of:

Where can rhi provide value?

rhi is able to draw on our experience and benchmarks from other energy projects when reviewing the existing project cost data. Our rhidata repository comprises a range of global projects across upstream, mid-stream and downstream and comprises both early stage estimating and tender data together with project outturn costs. rhidata is underpinned by our industry leading rhicoms Unit Rate contracting system which provides a further level of granularity in terms of rates, norms and productivity data.

For further information on rhi’s Due Diligence service offerings and relevant experience, please contact: mail@rhi-group.com

* for Technical evaluations of assets and Integrity Assessments, rhi partners with its parent company, Wood.

Article Authors: global managing director, David Paterson, strategy & business development director, David Lane and regional director, Mike Moore.